Filing an Income Tax Return (ITR) online has become a streamlined and efficient process with the new income tax portal. By logging in with PAN-based credentials and following a few straightforward steps, taxpayers can easily file their returns.

July is the month when most salaried taxpayers pay their taxes, as most companies provide Form 16 to their employees in the last week of June or the first week of July. Alongside Form 16, taxpayers need to have other key documents like Form 26AS, Annual Information Statement (AIS), Tax Information Statement (TIS), bank statements, and interest certificates for filing their tax returns.

Once you organize these documents and get ready for tax return filing, the next task is to find the right ITR form for which you are eligible. The Income Tax Department has notified seven forms – ITR-1 to ITR-7 – for the tax return filing for the financial year 2023-24.

Why File an ITR?

While filing an Income Tax Return (ITR) form, taxpayers declare their income, investments, tax deductions & exemptions, and taxes. Under the Income Tax Act, 1961, if an individual’s earning is more than the basic exemption limit, the person is mandated to pay income tax.

Filing an ITR also serves other purposes; so even if your income is not taxable because it falls under the basic exemption limit, it is advisable to file an ITR. Filing a tax return allows one to carry forward losses to the next fiscal years and claim a tax refund. ITR filing can also come in handy when obtaining a visa, securing loans from banks, and getting term insurance.

Steps for E-Filing Income Tax Return

E-filing is the process of submitting your tax return and completing all tasks digitally. To e-file a tax return, a taxpayer can access the new income tax portal with PAN-based login credentials and utilize various features that simplify the tax filing process.

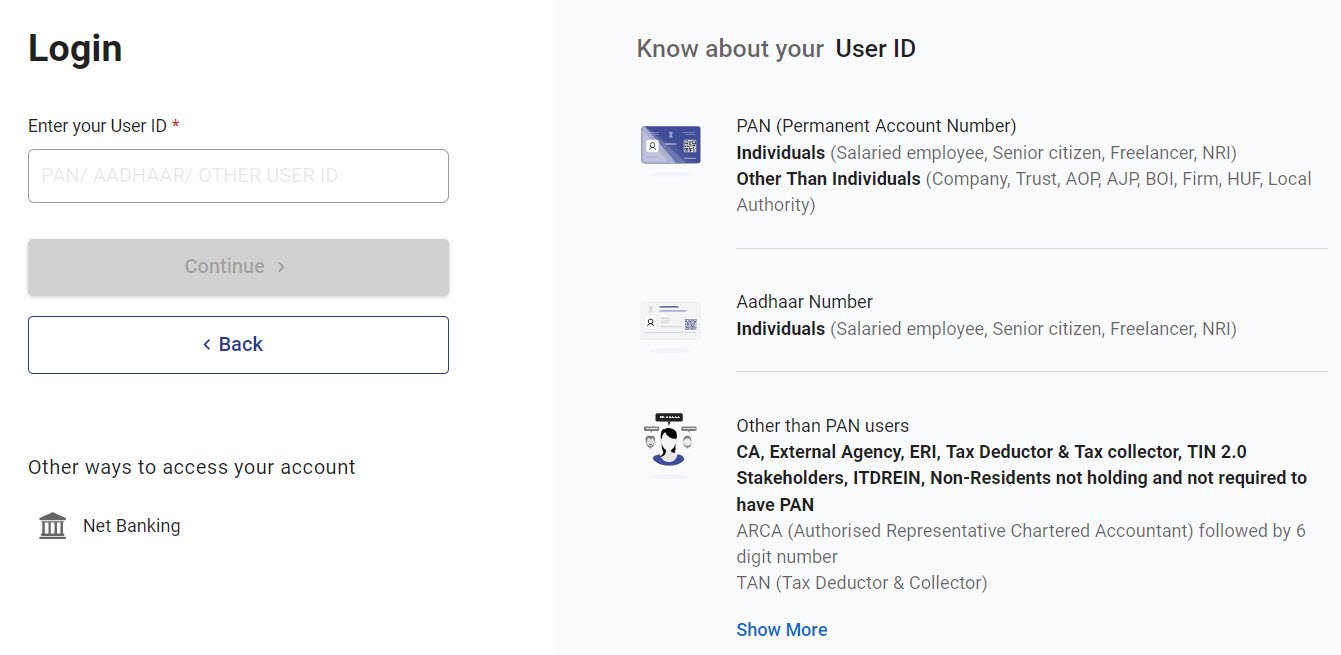

Step 1: Log In to the Income Tax Portal

Visit the official income tax e-filing website and click on ‘Login’. Enter your PAN in the User ID section and then click on ‘Continue’ and enter your password.

Click on ‘Continue’ to log in.

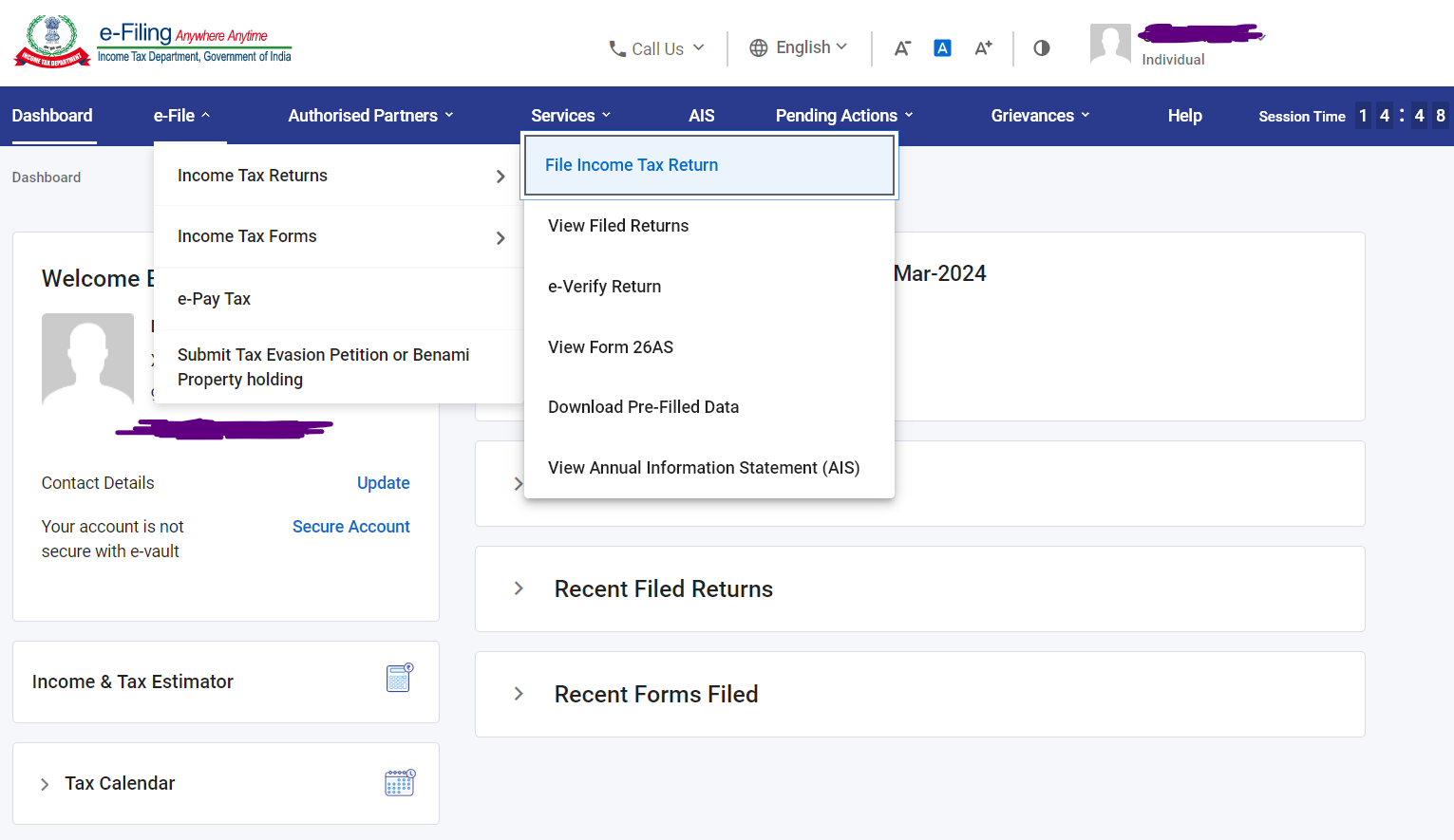

Step 2: Go to ‘File Income Tax Return’

Click on the ‘e-File’ tab and then select ‘Income Tax Returns’ and then click on ‘File Income Tax Return’.

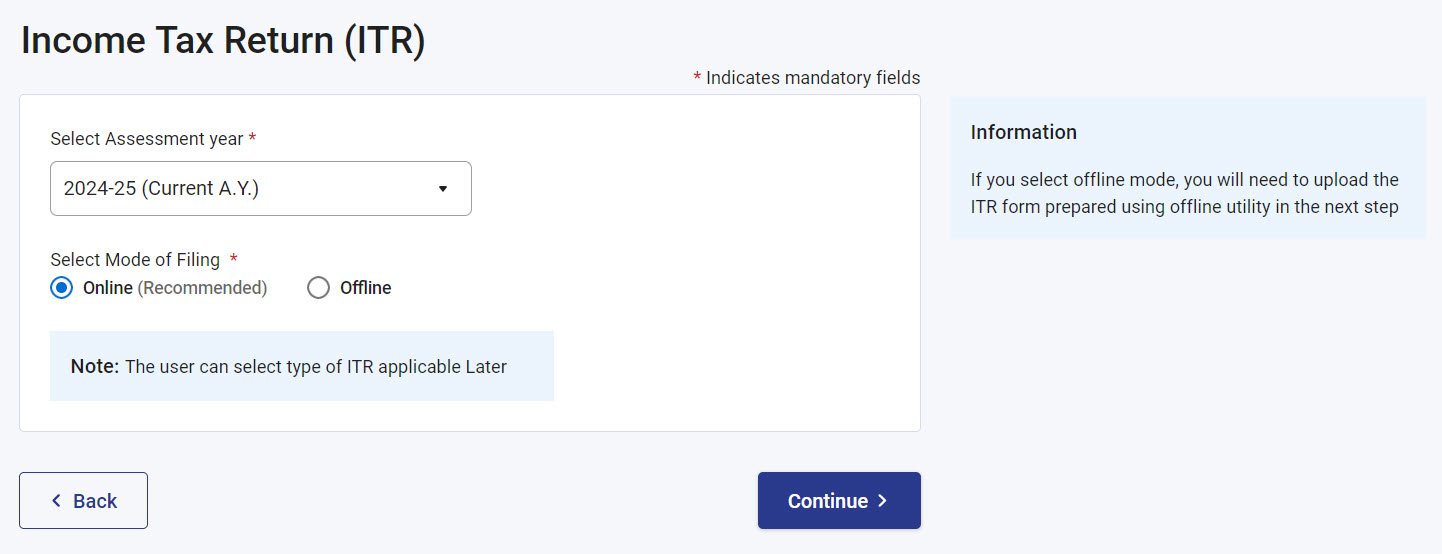

Step 3: Select the Right ‘Assessment Year’

Select ‘Assessment Year’ as ‘AY 2024-25’ if you are filing for FY 2023-24. Choose the mode of filing as ‘Online’.

Select the filing type as either ‘Original Return’ or ‘Revised Return’.

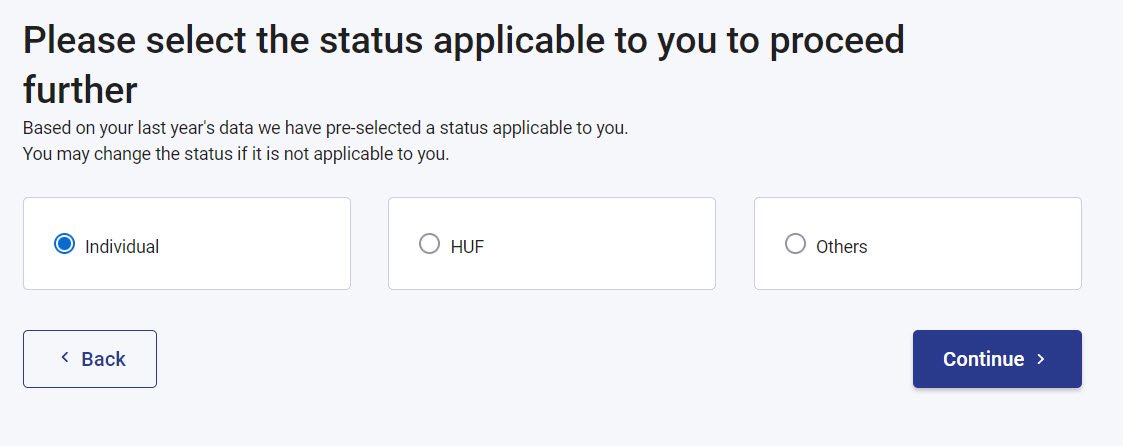

Step 4: Select the Status

Select your applicable filing status: Individual, HUF (Hindu Undivided Family), or Others. For most people, select ‘Individual’ and click on ‘Continue’.

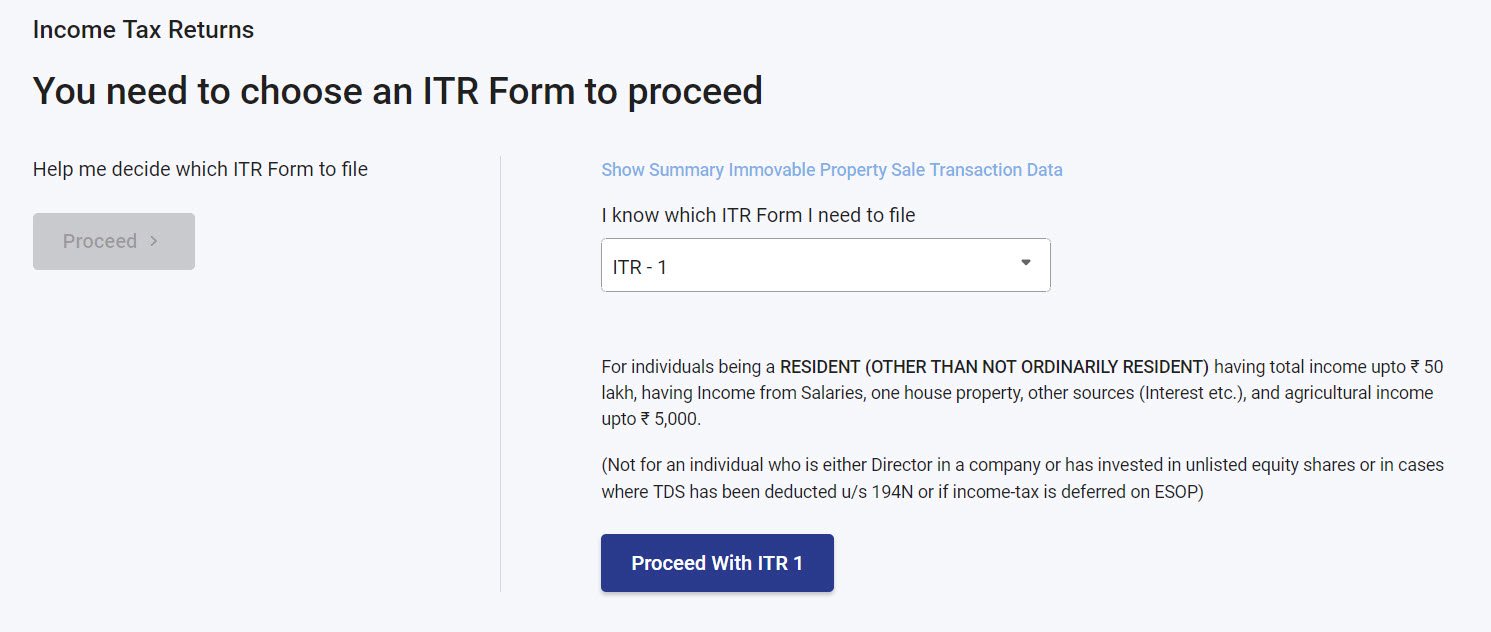

Step 5: Select ITR Type

Determine which ITR form you need based on your income sources. There are 7 ITR forms, of which ITR 1 to 4 are applicable for Individuals and HUFs.

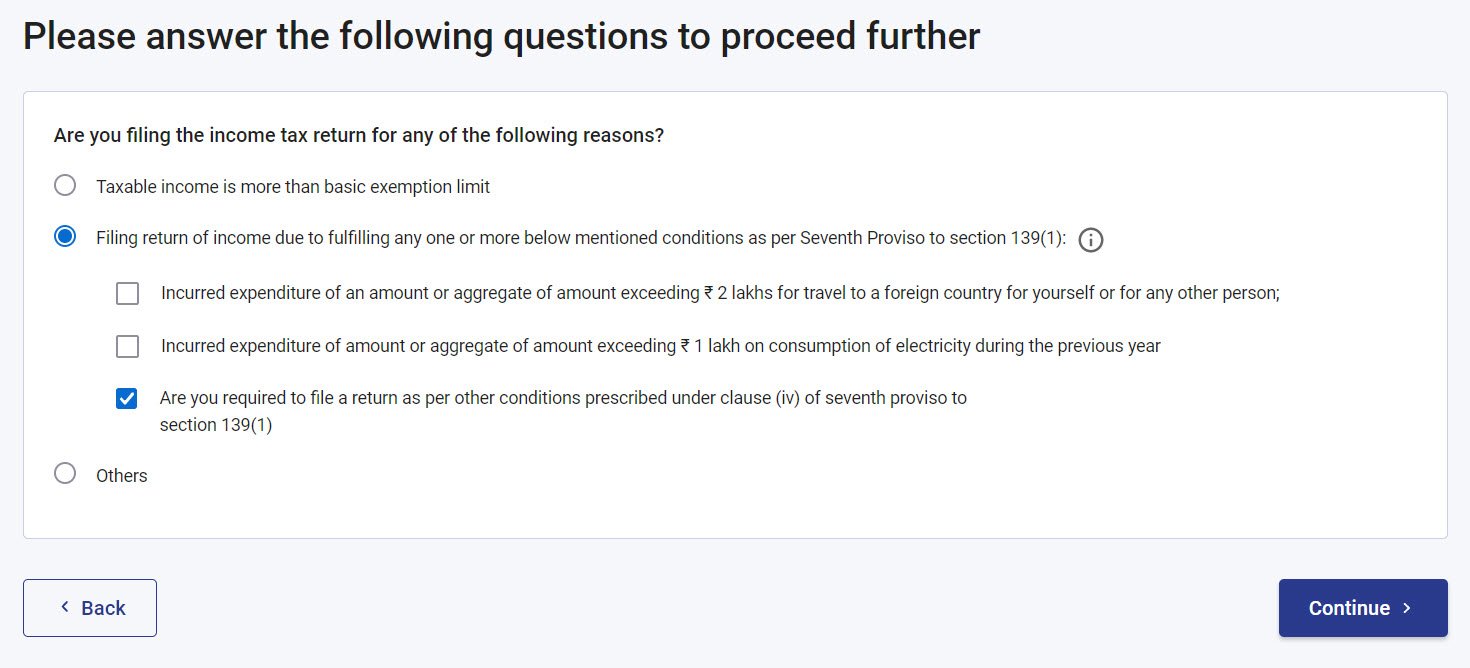

Step 6: Choose the Reason for Filing ITR

Specify the reason for filing your returns: taxable income above the exemption limit, meeting specific criteria, etc.

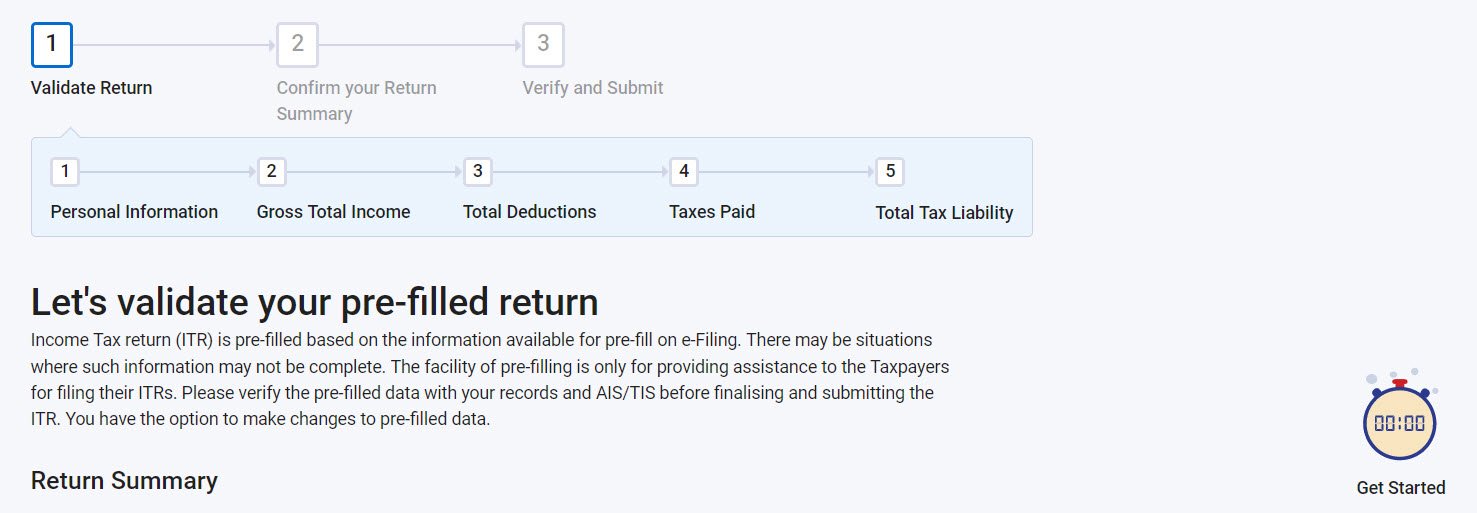

Step 7: Validate Pre-Filled Information

Validate pre-filled details such as PAN, Aadhaar, name, contact information, bank details and also review your income, exemptions, and deduction details.

Step 8: E-Verify ITR

1. The last step is to verify your return within the time limit (30 days).

2. You can e-verify using methods like Aadhaar OTP, EVC (Electronic Verification Code), Net Banking, or by sending a physical copy of ITR-V to CPC, Bengaluru.

By following these steps, taxpayers can efficiently complete the process of filing their income tax returns online, ensuring compliance with the Income Tax Act and availing themselves of the benefits of timely and accurate tax filings.

Pingback: ITR Refund Status – Check Income Tax Department’s Update on Processing - Edu Hyme